In this step, Dave Ramsey recommends saving up a starter emergency fund of $1,000. Thus, by saving up a small emergency fund, you can buffer yourself against having to rely on credit cards or personal loans the next time your car breaks down or your cat gets sick. One of the reasons people get into debt is because they’re not prepared to deal with emergencies. Baby Step 1 – Save $1,000 in an emergency fund

DAVE RAMSEY HOME AND BUSINESS SOFTWARE SERIES

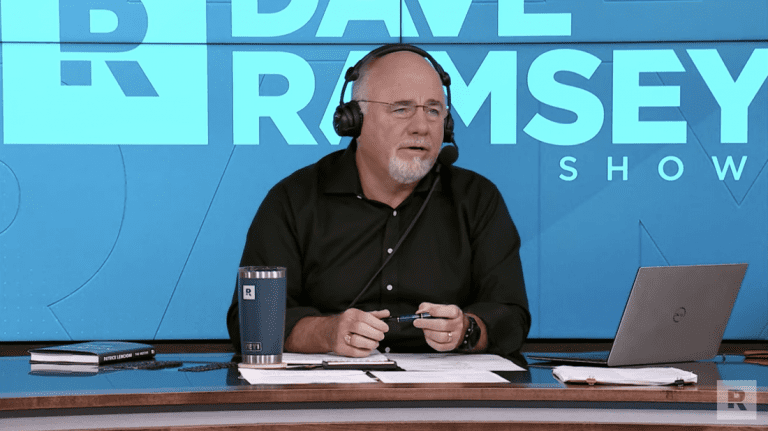

These are a series of actionable steps that you complete one by one to progress toward a healthier financial life. The cornerstone of all of his teachings is the Dave Ramsey Baby Steps. He blends together tough love, religion, and money management advice that helps people fix their financial habits and choices.

Ramsey also broadcasts his radio show as a YouTube channel.ĭave Ramsey has helped thousands of people around the world get out of debt. He also spreads his message through Financial Peace University, which are online or in-person financial classes held in churches around the country.

DAVE RAMSEY HOME AND BUSINESS SOFTWARE HOW TO

His business grew from there, eventually rebranding to Ramsey Solutions in 2014, but the focus on teaching people how to get out of debt and take control of their finances remained the same.ĭave Ramsey does this through his books such as The Total Money Makeover and Dave Ramsey’s Complete Guide to Money, and radio call-in show, The Dave Ramsey Show. He took the lessons and principles he learned and launched his own business coaching others and self-published his book Financial Peace University. Who is Dave Ramsey?ĭave Ramsey is a financial expert who learned how to manage his money after being stuck with a large amount of debt from real estate failures when he was younger.

There is a solution to these problems that’s becoming increasingly popular - Dave Ramsey’s Baby Steps, a seven-step process for getting out of debt, saving for emergencies, and improving your overall financial picture. That means that many families are spending spend hundreds of dollars per month on debt repayment, and thousands of dollars per year on interest According to a ValuePenguin study, the average U.S household debt is $5,700 and among credit card balance-carrying households, that number jumps to $9,333. If you don’t have any savings, you might need to rely on things like credit cards to pay for emergencies. Almost 30% of Americans don’t have any emergency savings at all, according to a 2019 Bankrate survey. And it’s an increasing problem among Americans. If you’re in debt, you know how much of a problem it can be.ĭebt can claim a large amount of your income, making it harder to balance your budget. If a purchase or signup is made through one of our Partners’ links, we may receive compensation for the referral. Our number one goal at DollarSprout is to help readers improve their financial lives, and we regularly partner with companies that share that same vision.

0 kommentar(er)

0 kommentar(er)